Indian stock markets staged a historic comeback on May 12, 2025, with benchmark indices delivering one of their strongest single-day gains in recent years. The rally was driven by a combination of geopolitical relief, strong earnings, and positive global sentiment. Both the BSE Sensex and NSE Nifty surged over 3.5%, cheering investors across the board.

Let’s take a detailed look at what happened today and what lies ahead for the markets.

Market Snapshot: Sensex and Nifty Post Record Gains

- Sensex jumped 2,975.43 points (3.74%) to close at 82,429.90

- Nifty 50 surged 916.70 points (3.82%) to settle at 24,924.70

This marked the most significant one-day gain for both indices since February 2021. Investor wealth rose by over ₹16 lakh crore, according to NDTV.

Why the Rally Happened: 5 Key Reasons

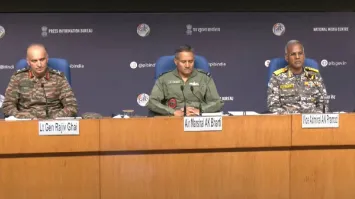

- India-Pakistan Ceasefire Agreement: The biggest relief came from the announcement of a U.S.-brokered ceasefire between India and Pakistan, calming fears of a prolonged conflict. More details on the ceasefire can be found here.

- Positive Global Cues: Progress in U.S.-China trade negotiations boosted overall global sentiment, adding fuel to the Indian market rally. Times of India covered the broader developments.

- Strong Q4 Corporate Earnings: A stellar performance by key companies, including Reliance Industries, helped build market momentum. For example, Reliance delivered a strong outlook, which excited investors.

- Technical Breakouts: With Nifty decisively breaching the 24,500 resistance zone, technical charts triggered momentum-based buying across sectors. A breakdown of levels is available here.

- Broad Sectoral Participation: The rally wasn’t limited to a few large caps. All sectoral indices ended in the green, suggesting widespread optimism.

Top Nifty 50 Gainers and Losers

Top Gainers:

| Stock | % Change |

|---|---|

| Infosys | +7.69% |

| Adani Enterprises | +7.60% |

| Shriram Finance | +7.16% |

| HCL Technologies | +6.43% |

| Trent | +6.42% |

Top Losers:

| Stock | % Change |

|---|---|

| IndusInd Bank | -3.40% |

| Sun Pharma | -3.36% |

Top Nifty 500 Gainers and Why They Rose

| Company | Price (₹) | % Gain | Reason |

|---|---|---|---|

| Cera Sanitaryware | 6,614.50 | +13.42% | Strong earnings and increasing demand in real estate and home upgrades. |

| Syrma SGS Technology | 541.70 | +13.22% | Renewed interest in semiconductor and electronics manufacturing. |

| JBM Auto | 691.75 | +11.44% | EV and auto components play; order wins and strong outlook. |

| Rail Vikas Nigam | 359.45 | +11.25% | Government infra push and strong Q4 numbers. |

| Jupiter Wagons | 370.10 | +10.71% | Railway-related capital expenditure boost expectations. |

Top Nifty 500 Losers and Why They Fell

| Company | Price (₹) | % Loss | Reason |

|---|---|---|---|

| KPR Mill | 1,181.75 | -9.53% | Profit booking after a recent sharp rally; weak demand signals. |

| Jyothy Labs | 350.80 | -4.34% | Muted quarterly results and margin pressure. |

| IndusInd Bank | 788.50 | -3.63% | Broader banking stress and sector rotation out of financials. |

| Navin Fluorine Intl. | 4,433.10 | -3.53% | Concerns over specialty chemical demand globally. |

| Eris Lifesciences | 1,404.90 | -3.51% | Weak revenue growth and competitive pricing pressure. |

Sectoral Performance: All Green

- Information Technology: Tech stocks outperformed, with Infosys and HCL Tech leading the charge.

- Metals: Strong commodity prices lifted metal names like Tata Steel.

- Financial Services: Despite some pressure in banks, NBFCs and insurance firms gained.

- Energy: Reliance and other upstream energy companies rallied on better earnings.

- Consumer and FMCG: A boost in consumption sentiment lifted these sectors moderately.

Analyst Commentary

- Nilesh Shah (Kotak AMC) noted that India remains in a multi-year earnings upcycle. He estimates Nifty EPS at ₹1160 for FY26, driven by better urban consumption and infra spending. Full interview here.

- Rupak De (LKP Securities) suggested traders should now be selective and focus on quality stocks given the sharp run-up. His insights are shared here.

What to Watch on May 13

- Corporate Results: Earnings announcements from Tata Steel, Bajaj Electricals and others will be on investor radar.

- Geopolitical Stability: Investors will closely track the ceasefire’s sustainability.

- Global Markets: Movements in U.S. and Asian indices will continue to impact local cues.

More day-ahead updates available here.

Today’s rally was not just a relief bounce, but a powerful reminder of how swiftly sentiment can turn in Indian markets. As volatility remains, investors are advised to focus on fundamentals and not get swayed by day-to-day euphoria.

Stay tuned for more updates as we track this market momentum into the week ahead.

We have covered similar post market analysis of previous Market days

Pingback: Bears take Market Control Amidst Profit Booking on May 13